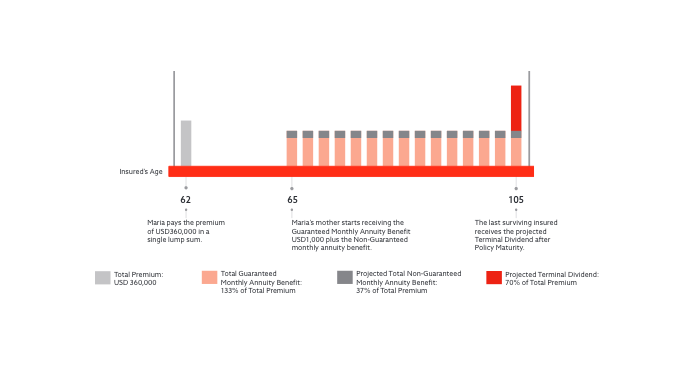

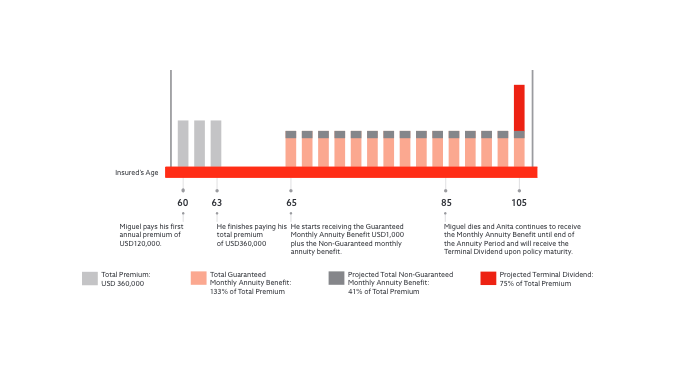

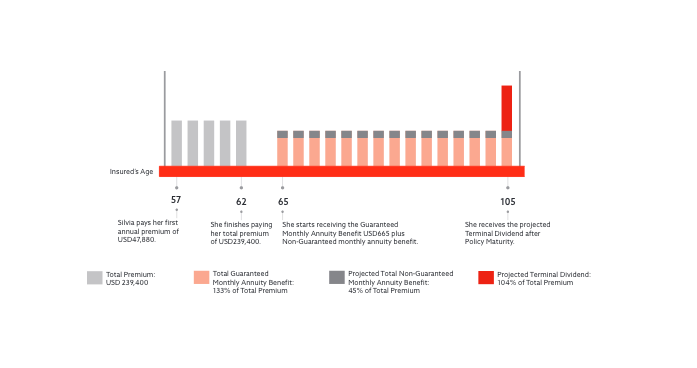

Maria, aged 40, is an Executive Director of an advertising company. Her parents are both 62 years of age and are almost at the age for retirement. She plans to give her parents a stable monthly income after their retirement. Therefore, she subscribes to RetireJoy Annuity Plan for her parents.

Maria’s mother (Policyholder) will receive a Monthly Annuity

Benefit starting from the age of 65 until 105. In the unfortunate

event of death of Maria’s mother, Maria’s father (Second Insured) will become the policyholder and continue to receive the Monthly Annuity Benefit until end of the Annuity Period, and in such situation, the Maturity Benefit (Terminal Dividend) will be paid at Policy Maturity.